IMARC Group has recently released a new research study titled “South Korea Mobile Payment Market Report by Payment Type (Proximity Payment, Remote Payment), Application (Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, and Others), and Region 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Mobile Payment Market Overview

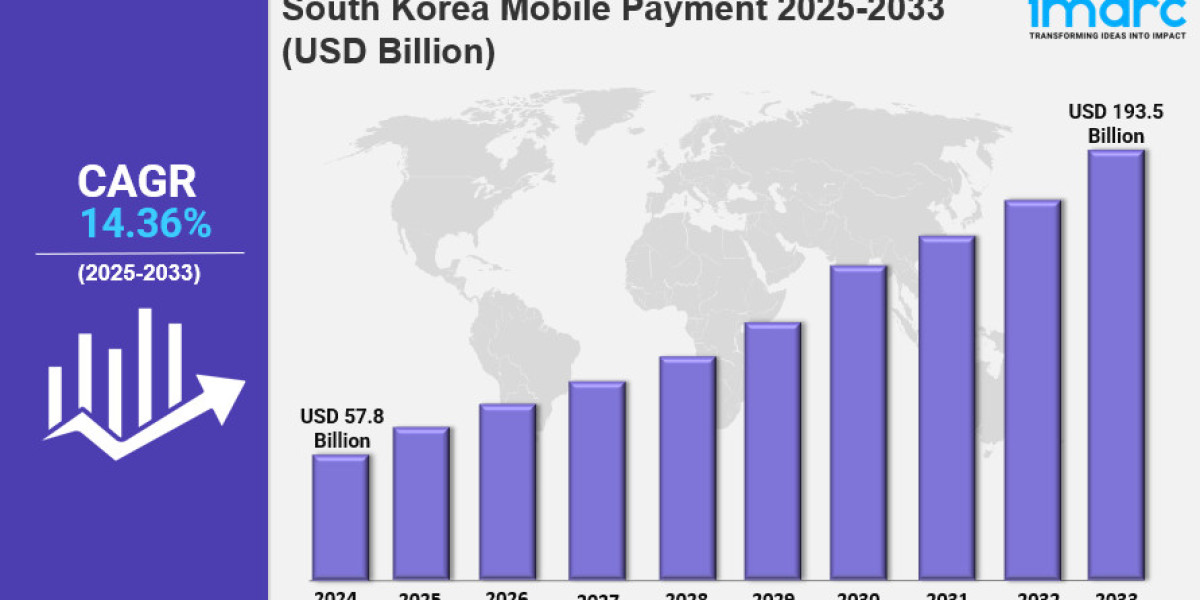

The South Korea mobile payment market size of USD 57.8 Billion in 2025. Forecasts indicate the market will grow to USD 193.5 Billion by 2034, exhibiting a CAGR of 14.36% during the forecast period from 2026 to 2034. This growth is driven by increased smartphone usage across age groups and a rising preference for online shopping, fueling demand for mobile payment solutions.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

South Korea Mobile Payment Market Key Takeaways

- Current Market Size in 2025: USD 57.8 Billion

- CAGR (2026-2034): 14.36%

- Forecast Period: 2026-2034

- Partnerships between fintech startups, banks, and tech giants are enhancing value-added services and user-friendly mobile payment interfaces.

- Growing culture of online shopping and preference for quick, cashless transactions is accelerating mobile payment adoption.

- Regional growth varies: Seoul Capital Area leads due to advanced infrastructure; Yeongnam grows with rising e-commerce; Honam and Hoseo develop alongside mobile payment infrastructure expansion.

- Uneven regional adoption of mobile payments poses challenges, but expansion of digital infrastructure and user education presents opportunities.

- Cross-border QR code payment initiatives and digital asset wallet launches cater to enhanced convenience and tech-savvy consumers.

Sample Request Link: https://www.imarcgroup.com/south-korea-mobile-payment-market/requestsample

Market Growth Factors

The South Korea mobile payment market benefits significantly from partnerships among fintech startups, banks, and technology giants. These collaborations focus on delivering value-added services and designing user-friendly interfaces, which simplify mobile payment usage and expand adoption across different consumer segments. This strategic cooperation is fueling market growth by making mobile payments more accessible and integrated within the financial ecosystem.

Country-wide, a cultural shift toward online shopping and a strong consumer preference for rapid, cashless transactions are major growth drivers. The convenience and speed offered by mobile payment methods meet the expectations of tech-savvy consumers and busy lifestyles, enhancing demand. Mobile payments have thus become central to retail, transportation, hospitality, and other sectors' transactional processes.

The uneven adoption of mobile payment technologies presents challenges. However, the ongoing expansion of digital infrastructure and efforts to educate users build trust and familiarity with these systems. These improvements help overcome technological and regional disparities, contributing to steady market growth. Moreover, increasing cross-border payment collaborations, like those between South Korea and Cambodia, and innovations such as digital asset wallets integrated with blockchain, cater to growing consumer needs for convenience and digital finance solutions.

Market Segmentation

Breakup by Payment Type:

- Proximity Payment

- Near Field Communication (NFC): Enables quick, contactless transactions using close-range wireless communication technology.

- Quick Response (QR) Code: Facilitates fast, contactless payments via scannable codes commonly used in retail and service businesses.

- Remote Payment

- Internet Payments: Online payment methods allowing consumers to purchase goods and services via the web.

- Direct Operator Billing: Payments charged directly through mobile network operators for convenience.

- Digital Wallet: Electronic wallets storing payment information and enabling seamless online and offline transactions.

- SMS Payments: Transactions completed through text messaging services.

Breakup by Application:

- Entertainment: Mobile payments used for purchasing digital content, event tickets, and gaming.

- Energy and Utilities: Facilitates payments for electricity, water, gas, and other utilities via mobile platforms.

- Healthcare: Enables payment for medical services and health-related products through mobile devices.

- Retail: Supports transactions in physical and online retail stores via mobile payment methods.

- Hospitality and Transportation: Streamlines payments for accommodation, dining, and transport services.

- Others: Encompasses other sectors adopting mobile payment technologies.

Breakup by Region:

- Seoul Capital Area: Dominant market due to advanced infrastructure and tech-savvy consumers.

- Yeongnam (Southeastern Region): Experiencing steady growth fueled by e-commerce expansion and increasing digital transactions.

- Honam (Southwestern Region): Developing as mobile payment infrastructure improves.

- Hoseo (Central Region): Growth progressing with enhancement of mobile payment facilities.

- Others: Other regions showing advancement as digital payment solutions spread.

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=17683&flag=C

Regional Insights

The Seoul Capital Area leads the South Korea mobile payment market, driven by its advanced infrastructure and a population of tech-savvy consumers. Yeongnam region shows steady growth, supported by rising e-commerce activities and digital transactions. Honam and Hoseo regions are catching up with ongoing improvements in mobile payment infrastructure, contributing to more widespread adoption. Other regions also demonstrate growth influenced by overall digital advancements, fostering an increasingly connected financial ecosystem.

Recent Developments & News

In September 2024, Cambodia and South Korea launched a cross-border payment system enabling Jeonbuk Bank customers to make QR code payments in Cambodia, aiming to boost economic ties and tourism. In August 2024, Naver introduced the Naver Pay Wallet, its first digital asset wallet in partnership with Chiliz, incorporating blockchain technology to manage cryptocurrencies and loyalty programs. Earlier in June 2024, Busan launched Busan Pay, the first mobile payment service exclusive for foreign tourists, offering local currency payments, transportation access, and attraction discounts with multilingual support to enhance tourism.

Key Players

- Kakao Pay Corp.

- Naver Corporation

- NHN PAYCO Corp.

- Samsung Electronics Co. Ltd.

- SK pay

- Viva Republica Inc.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302